Reducing power costs and outage risks for Connecticut businesses

Blackouts have been a steadily growing concern in Connecticut, with powerful storms delivering heavy rain and winds that have caused multi-day grid outages affecting thousands of customers in recent years. A particularly infamous power outage over Christmas in 2022 left over 100,000 Eversource customers without power at its peak, which contributed to Eversource finishing next to last in the 2022-2023 American Customer Satisfaction Index energy utility rankings.

Climate change is steadily cranking up the severity and the frequency of these extreme weather events, and the cost of these outages for businesses can add up to a lot more than a ruined holiday party. To its credit, the Connecticut Public Utilities Regulatory Authority (PURA) has recognized this problem and is offering support to encourage businesses in the state to adopt the best near-term solution: on-site battery storage systems.

A number of companies have taken advantage of this support, but there are many, many more that have been unable to participate due to a lack of bandwidth, expertise, or budget.

Scale is looking to partner with these businesses to help them realize the resilience and cost savings benefits of batteries through our financed energy services solution. We provide our partners with experience in navigating government programs, technical expertise to optimize system designs, the operational know-how to ensure maximum savings and reliability benefits, and the capital resources to fully finance these systems for $0 down.

Why batteries make sense for Connecticut businesses

Like backup generators, battery storage systems can ensure your company’s operations keep up even when the grid goes down. The ability to avoid outages can be enormously valuable for many businesses, and too many companies without reliable backup have had to learn exactly how much every hour of lost power impacts their bottom line. While predicting the frequency and duration of these outages is inherently challenging, this clear and growing risk has motivated many businesses to invest in diesel- or gas-fueled backup generators.

Battery service offerings similarly allow you to manage these outage risks by taking charge of your reliability and resilience needs, but with a superior overall value proposition. In contrast to backup generators, which are simply an added expense to your business including both up-front equipment costs and refueling costs, batteries can provide electricity cost savings year-round, even on normal operating days – essentially turning a cost center into a profit center.

Typically, these cost savings accrue from three separate value streams:

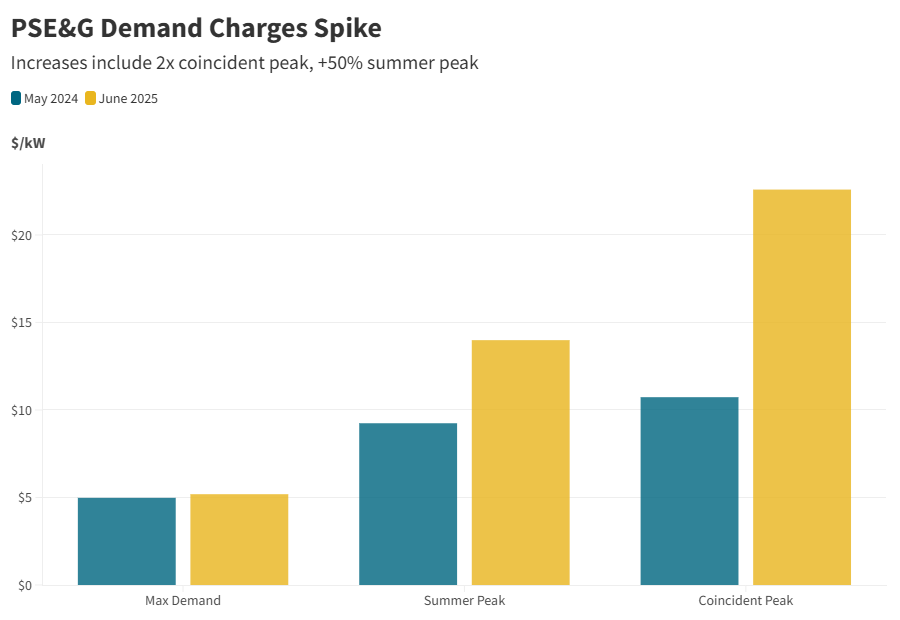

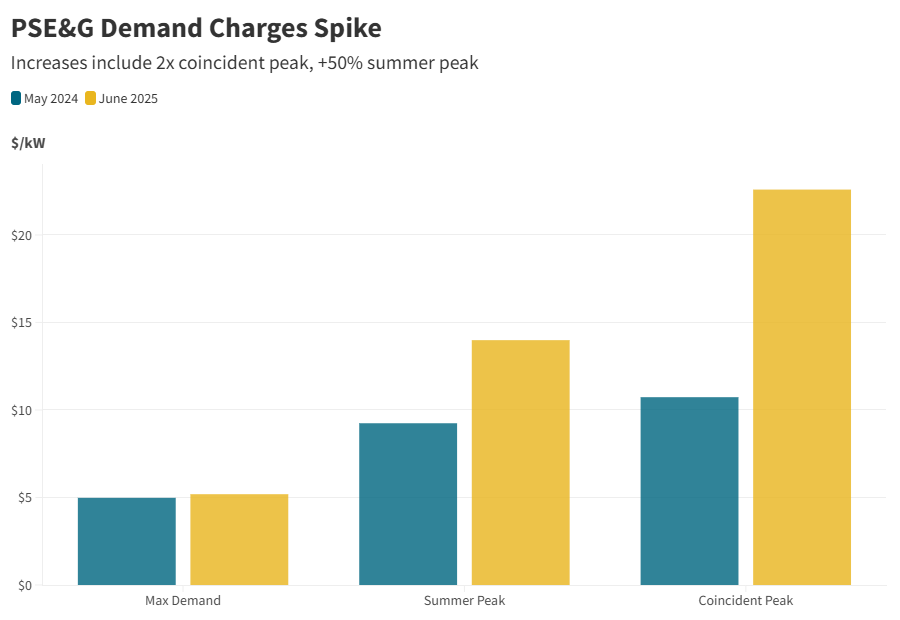

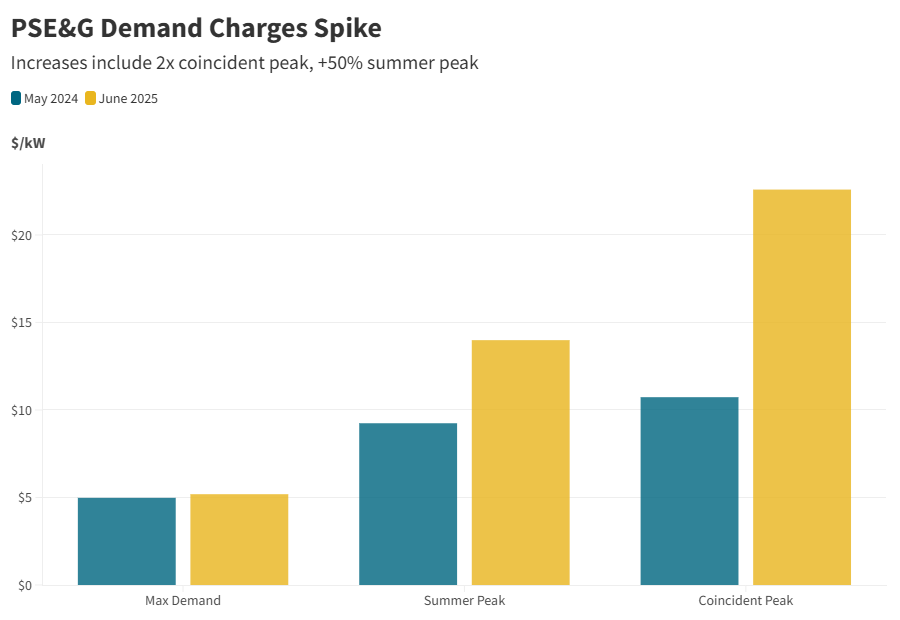

- Avoiding demand charges: Demand charges are based on the highest level of power consumed in a given hour during a monthly billing period. New England has some of the highest demand charges in the country, and this can often comprise a significant portion of many Connecticut businesses’ electricity bills. By tapping into an on-site battery during hours of peak load, businesses can reduce the amount of power they need to draw from the grid and thereby reduce demand charges, in a process referred to as demand charge management.

- Reducing peak capacity charges: Utilities in Connecticut also charge a fixed annual fee based on a customer’s ICAP tag, which measures their peak kW draw on New England’s broader system (ISO-NE) during the hour of highest grid demand during the year (typically a hot summer day). Similar to the management of monthly demand charges, an optimized battery system can reduce the facility’s peak load at these exact times, enabling a business to qualify for a lower ICAP charge, commonly referred to as CAP-Tag management.

- Buying electricity when it’s cheapest: Batteries also enable businesses to take advantage of the significant cost differential between kilowatt-hours consumed during on-peak hours versus off-peak hours. An optimized system can charge batteries during cheaper off-peak hours and then draw on that stored electricity during more expensive on-peak hours, potentially resulting in significant per-kWh savings referred to as energy arbitrage. Pairing batteries with cleaner, low-cost on-site generating assets like solar panels can deepen these cost-saving opportunities alongside their emissions benefits.

The benefits of these battery systems may increase over time. For example, many companies are planning a transition to electric vehicle (EV) fleets, but on-site charging can radically increase a facility’s energy draw – and, thus, its energy use, demand charges, and in some cases its ICAP tag. Batteries can be invaluable in managing all of these cost impacts of your EV transition, as well as avoiding or minimizing the potential costs and lengthy delays that typically accompany a utility upgrade of your on-site hosting capacity.

Another potential future revenue stream for batteries is participation in “virtual power plants” or VPPs, an emerging application that coordinates the operation of batteries and other distributed energy resources. This provides resilience benefits for the entire grid during times of peak demand, effectively combining batteries from multiple sites to act as if they were a large power plant. Participation in VPPs is already providing additional revenues for on-site batteries in a growing number of states, and as Scale builds its portfolio across Connecticut we will be pursuing these opportunities on behalf of our customers.

Why work with Scale

Businesses with battery systems meeting certain design requirements can receive a capital incentive from PURA that reduces up-front costs, as well as annual performance incentives for customers that allow their systems to be used to support the grid during emergencies. These performance incentives are in place for 10 years, which is typically long enough to cover the remaining initial capital outlay.

While some companies have the budget and energy management expertise to take advantage of these long-term incentives, there are many businesses that don’t. Indeed, many energy management and battery service providers lack experience designing and operating the type of projects that will meet this program’s qualifications, which include requirements for battery sizing, “islanding” capabilities that enable continued operation during grid outages, and the ongoing provision of grid services during designated events.

As a national leader in on-site energy solutions, with financial backing from private equity firm Warburg Pincus, Scale can make the process of battery adoption dramatically easier in three ways:

- Technical expertise: Our team of highly experienced project developers can design the best battery system to meet your needs, taking into consideration factors including your facility’s energy requirements, the performance characteristics of different battery systems, and state program requirements for system sizing, islanding capabilities, and ability to participate in incentive programs.

- Operations management: Scale’s energy management software can optimize the charging and discharging of your system to maximize energy cost benefits from demand charges, peak capacity charges, energy arbitrage opportunities, and incentive program participation, while also ensuring your system is prepared to meet your backup power needs in case of an outage.

- Financing capabilities: Scale’s Microgrid Services Agreement (MSA) is an energy services contract model, which allows us to offer customers these battery systems for $0 down and a set price annually covering the capital and O&M costs of the project in one payment. Under this MSA, Scale owns the microgrid and simply charges customers for energy services provided, similar to an Energy Services Agreement (ESA) that lowers overall energy costs. This model replaces a substantial up-front capex with a monthly opex, allowing businesses to avoid additional debt burden while also eliminating operational risks and the complexity of managing incentive program participation.

Get ahead of the next storm – and ahead of program changes

The Connecticut battery program is open for business, and if you want to ensure your business stays open during the next grid outage, the time to take advantage of this opportunity is now. Program funding is available but limited, and changes to the program design are expected this summer, which could potentially introduce new requirements or limitations. If you’re a Connecticut business worried about mounting reliability risks, increasing electricity costs, or both, Scale can help you reserve funding simply by signing a Letter of Intent.

There’s never been a better time to secure some peace of mind with an on-site battery system, and Scale’s experienced team of distributed energy and financing experts are ready to make it easy to get started.